One important feature of the evidence given to the Bach Commission on Access to Justice was the need to develop and use simple applications of modern technology as a tool to help lay people, advice services and law centres to access clear expositions of modern law expressed in terms non-lawyers can readily understand.

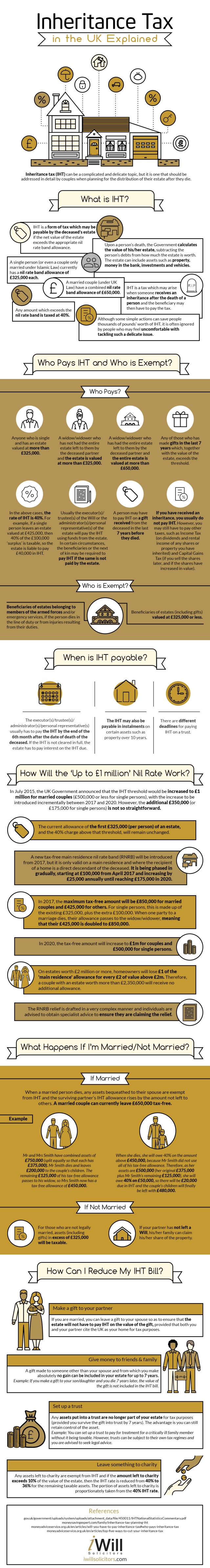

I was therefore delighted when Rizwan Rashid, who is the Practice Manager for I Will Solicitors, sent me today a copy of the “infographic” he has prepared on the topic of Inheritance Tax – what it is, who has to pay it, what happens if you are married or unmarried, how you can legitimately reduce your IHT bill (without being involved in aggressive tax avoidance…), and so on. It also gives an overview of how the Governement’s decision to increase the IHT threshold to £1 million (or £500,000 for single people) will work.

He said he would be happy if I were to reproduce it on my site, so long as I give credit where credit is due – to his website at http://www.iwillsolicitors.com/our-services/inheritance-tax-planning/, which I gladly do.

So here it is:  Needless to say, although its contents look splendid to me, I am so far out of touch with the practice of the law that I can give no personal guarantee of its accuracy!

Needless to say, although its contents look splendid to me, I am so far out of touch with the practice of the law that I can give no personal guarantee of its accuracy!

I will be happy to consider republishing any other high quality material of this kind that readers care to send to me.

Very useful. For completeness, in your second paragraph, I think you meant 500k not 500 million for single people? That would be extraordinarily generous!

LikeLike

Thank you, Paul. Correction duly made. If only I had £500 million to distribute, it might have tempted me to become single again…

LikeLike